Vivakor: Dead Cat Bounce Potential? Or Just Dead?

2025 was not a kind year for Vivakor, Inc. (VIVK) shareholders. Particularly those retail shareholders who did some dumpster diving in the last couple of weeks and are already staring at a loss of around 90%. The stock got suddenly delisted from the NASDAQ last Friday, resulting in a 65% drop to just over $0.01 on over 100 million shares traded. This is usually a prime spot for me to try to pick up some shares on a dead cat bounce. I love a good recently delisted or bankruptcy bounce play.

The first roadblock to a successful dead cat bounce trade here is the volume. It was over 122 million on Friday and sold off throughout the day. Usually getting kicked to the pink sheets results in a stock’s volume getting deflated as much as the stock price. This wasn’t the case for VIVK. I find that a good dead cat bounce candidate tanks on LOW volume, not high volume. Brokers disallow buys from retail but allow them to sell, creating a temporary supply-demand imbalance that corrects itself in the following days. Too many buyers exist at this level for this to be an easy 2-10x return here. So this is strike one.

The second strike is that the fundamentals are a pure mess. Look at the last set of financials. The working capital deficit is nearly $70 million and the operating loss was $9 million last quarter. The company is effectively insolvent. It has been making headway in paying down some debt, but that has come at the cost of substantial dilution with the share count growing from 48 million to 174 million in just one quarter.

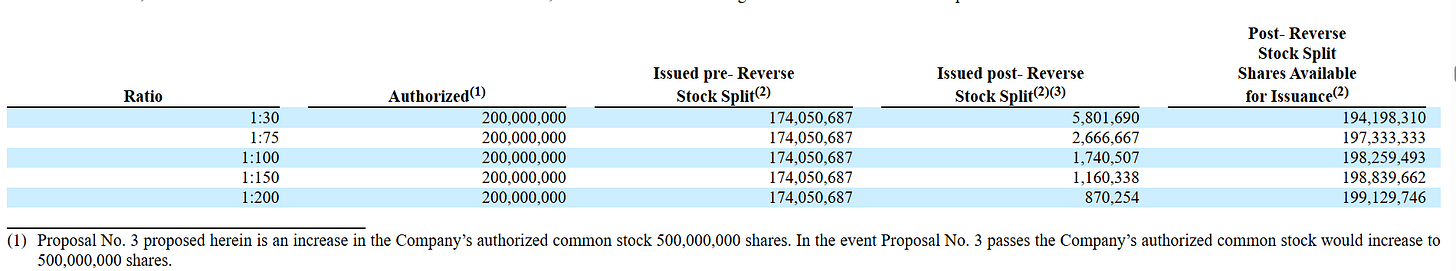

Strike three comes with the recent proxy statement and subsequent approval of all proposals at the special meeting held last week. The proxy statement outlines the mess of toxic and convertible financings that took place to try to clean up the balance sheet that led to the ballooning share count. I’m not going to get into it all, I’ll just summarize it by saying it’s bad for shareholders. But the approved proposals tell you where the stock price is really headed in the not-too-distant future. First, a reverse split between 1-for-30 and 1-for-200 will take place some time on or before March 15, 2026. This is par for the course as the company tries to get its shares relisted on the NASDAQ. However, in addition to the reverse split, the authorized share count will increase from 200 million to 500 million. The company made it very clear as outlined in this chart below that the reverse split will NOT reduce the amount of authorized shares:

So should the company enact a 1-for-200 reverse split, there will be about a million shares outstanding and 500 million authorized shares, leaving 499 million shares to be issued. For anyone who is familiar with the shenanigans of listings like ADTX or MULN (now BINI), you know what can happen to a stock price when a company is given this much of a blank check to issue shares. It could still bounce like any other stock could, but I don’t like the odds of a sustained run while I do like the odds of a massive tank and more dilution once the reverse split is enacted.

I am watching this train wreck from the sidelines in the off chance that I might lay down some lottery ticket money before the reverse split takes place.

Disclosure: No position on VIVK. I may consider a small purchase for a swing trade at some point in time, but I don’t consider it likely.